- #Irs internal phone numbers how to

- #Irs internal phone numbers verification

- #Irs internal phone numbers professional

- #Irs internal phone numbers series

This how-to guide will show you a step-by-step approach to reaching a live person at the Taxpayer Advocate Service to schedule an appointment at a local office near you. They can help you resolve tax problems and protect your rights as a taxpayer. To get help from the Taxpayer Advocate Service, call 87. The Taxpayer Advocate Service is an independent organization within the IRS that assists taxpayers experiencing financial difficulties or other issues.

#Irs internal phone numbers how to

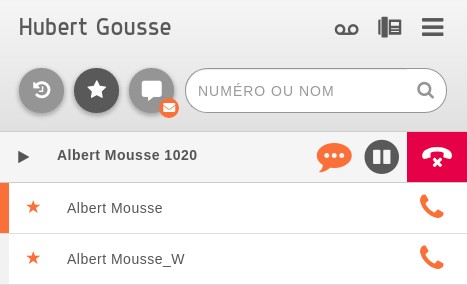

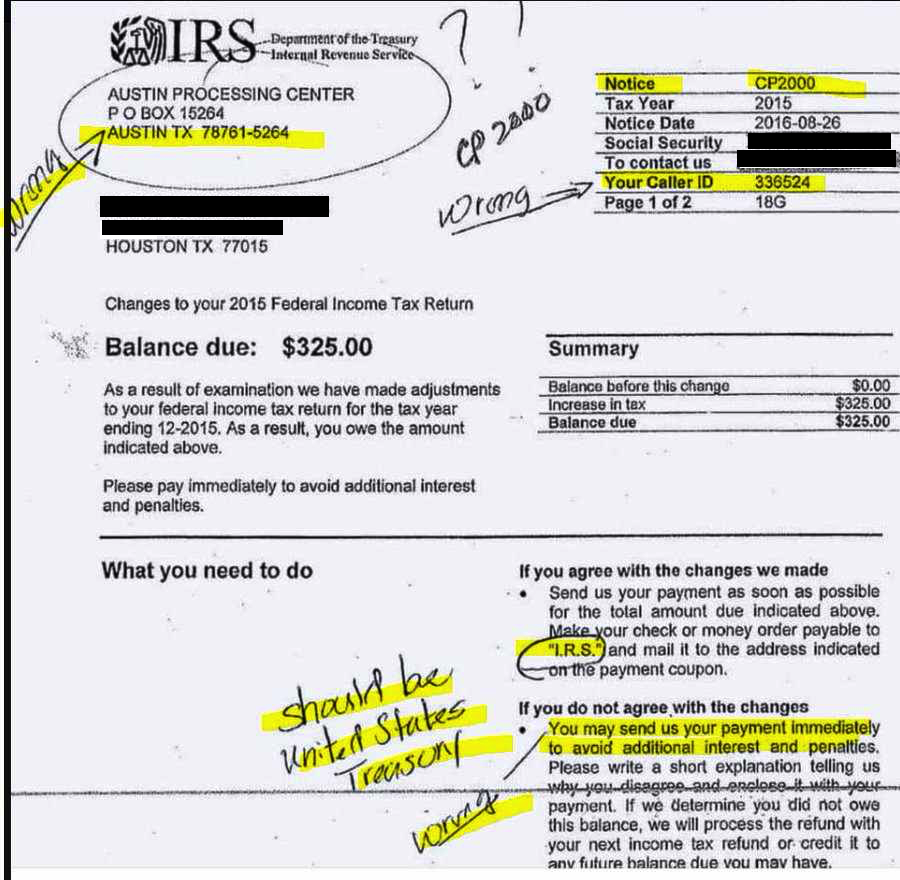

This guide will show you how to dial and reach Taxpayer Assistance Center representative to schedule an appointment at a local office near you. Scheduling an appointment can help you avoid long wait times and ensure you receive personalized assistance. Be prepared to provide your Social Security number, name, address, and other personal information. To schedule an appointment at a local IRS office, call 84. Return to top Schedule an Appointment at a Local IRS Office This guide will save you significant time attempting to find an IRS agent to speak with. You can learn more about how to navigate the balance due phone number menu. By calling this number, you can determine the best course of action to settle your balance due. The IRS offers various ways to pay, including online payments, installment agreements, and offers in compromise. If you have an outstanding balance with the IRS, call 80 to learn about your payment options. The IRS updates the refund status regularly, so calling this number will give you the most up-to-date information.Ĭheck out this guide to learn calling about your tax refund. You'll need to provide your Social Security number, filing status, and the exact amount of your refund. To check the status of your tax refund, call 80. Check out how to verify your identity over a phone call. This will help the IRS confirm your identity and assist you in resolving any identity-related issues.ĭealing with ID.me and the IRS to verify your identity can be a nightmare wrapped in red tape. Be prepared to provide your Social Security number, address, and other personal information. If you've received a notice from the IRS asking you to verify your identity, call 26. Tired of waiting on hold for hours when calling the IRS customer service phone line? Check out this guide to learn how to speak to a live person at the IRS using a shortcut or a calling tool like Claimyr that guarantees a callback with an agent on the line and zero hold time.

#Irs internal phone numbers series

Remain patient and attentive, as reaching a live human may require navigating through a series of options. To speak with a live person at the IRS main phone line, dial 80 and follow the automated prompts. How to get a live human on the phone at the IRS

Get help with the EFTPS (Electronic Federal Tax Payment System)

#Irs internal phone numbers professional

Get assistance with tax professional accounts and tax law Protect your identity and learn about IP PINs Get assistance with Individual Tax Return e-Filing Understand and respond to a Notice Received Learn about the Taxpayer Protection Program 4883C Get help from the Taxpayer Advocate Service Schedule an Appointment at a Local IRS Office

#Irs internal phone numbers verification

Resolve identity issues with the IRS Identity Verification How to get a live human at the IRS main phone line 👋 Public service announcement: Be sure to click the "Dialing Tips to Reach a Human" section to learn a few tricks before wasting your time dialing. If it's too hard to call the IRS, you can place an IRS call here to guarantee you reach a human. IRS Phone Number: Human Help and Customer Serviceīy Thomas Maxon, CEO & Co-founder of Claimyr | īeen dialing the IRS phone lines 80 to call a human? This comprehensive list of IRS phone numbers will save you hours of calling by helping you find the correct department you need to speak with.

0 kommentar(er)

0 kommentar(er)